Let’s dive into how this impacts our key states—Colorado, Texas, and Florida—based on the latest year-over-year changes from the 20-City Composite, where applicable, and broader trends.

In the Denver-Aurora-Lakewood metro, part of the 20-City Index, home prices have shown signs of softening. While exact statewide data isn’t isolated, Denver’s trend suggests a statewide moderation, with recent months indicating a pullback from earlier gains.

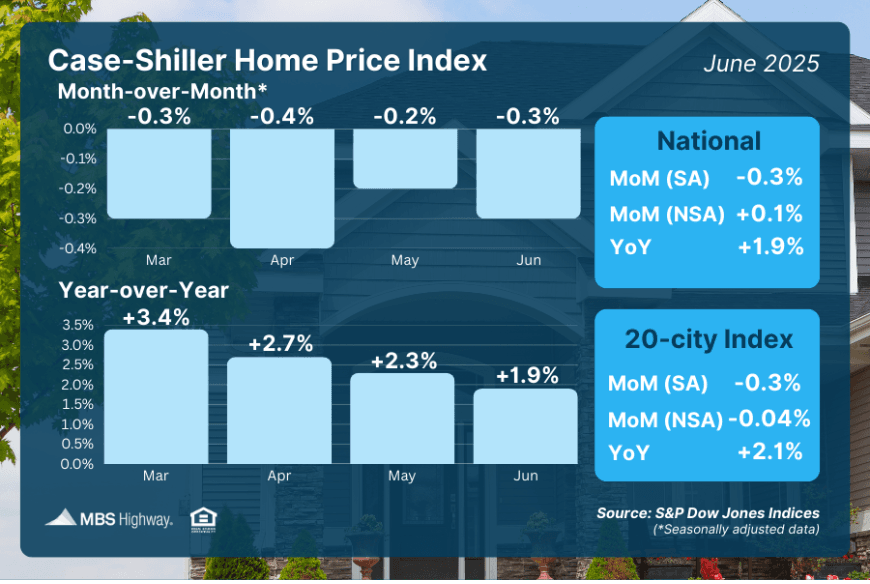

For Colorado agents, this cooling—potentially aligning with the national -0.3% month-over-month drop—opens doors for buyers. It’s a prime opportunity to steer clients toward properties that build long-term wealth. At Efficient Lending, we focus on low-cost mortgages tailored to your clients’ needs, helping them secure homes and equity even as prices stabilize.

Dallas-Fort Worth, also in the 20-City Index, reflects Texas’s broader market trend. The state’s year-over-year growth has tapered, with Dallas showing a modest decline in recent monthly data, consistent with the national -0.3% (SA) shift.

Texas agents can leverage this buyer-friendly environment, especially for first-time homeowners and investors.

I’m passionate about explaining the nuances of mortgage options, ensuring transparency and trust. With Efficient Lending’s low-cost solutions, we empower your clients to turn this market shift into a foundation for generational wealth.

Miami-Fort Lauderdale-West Palm Beach, another 20-City Index metro, indicates Florida’s resilience with a slower decline compared to other regions.

The statewide market likely mirrors this, with the national -0.3% month-over-month trend suggesting stabilization rather than a sharp drop.

For Florida agents, this is a chance to highlight durable neighborhoods and educate clients on legacy-building through real estate.

The attached Case-Shiller chart underscores a market in transition: positive year-over-year growth (1.9% nationally, 2.1% for the 20-City Index) masks monthly declines (-0.3% SA), pointing to a normalization post-boom. For agents, this is a golden opportunity to position yourselves as trusted advisors, using data to craft winning strategies.

At Efficient Lending, Inc. (NMLS: 1876539), we share your dedication to understanding clients’ needs with integrity and transparency. Whether it’s a purchase in Colorado’s foothills, a refinance in Texas, or an investment in Florida’s coast, our low-cost mortgages help build wealth and legacy.

I love building relationships—call me to explore how we can collaborate on your next deal.

For deeper insights, tune into my podcast, Mosaic: The Stories of Real Estate, where we explore strategies for generational wealth.

Visit my WEBSITE for tailored mortgage resources.

Follow me on X @mike_lending for daily updates.

Let’s create lasting partnerships and successful outcomes together.

Michael F Nelson, CEO - Efficient Lending, Inc

720.419.3016 or mike@efficientlending.net or @mike_lending

NMLS: 1876539 NMLS: 1314188