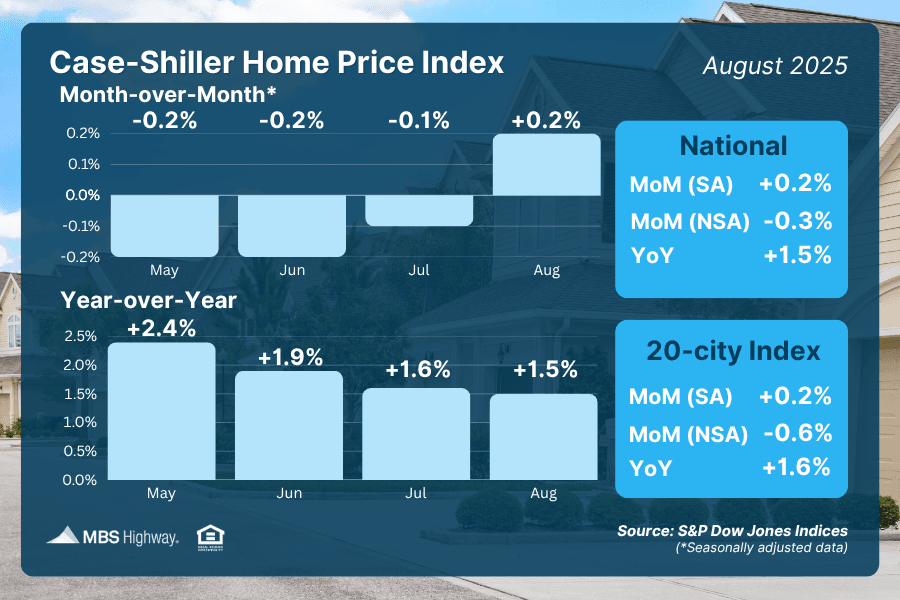

Between July and August, U.S. home values fell 0.3% before adjusting for seasonal trends. But here's the key nuance: once we account for those typical summer slowdowns (think vacations, school starts, and fewer listings), values actually rose 0.2%. Even better? Home prices are still 1.5% higher than they were a year ago.

This isn't a crash—it's more like a gentle speed bump on a road that's been climbing steadily.

I always tell my clients: raw numbers can be misleading without context. Summer is historically quieter for real estate. Families are less likely to list homes, and buyers might hit pause. That's why economists use seasonal adjustments—to reveal the true underlying trend. That 0.2% gain? It's a sign of resilience in a market that's cooling off from the frenzy of recent years but far from collapsing.

At Efficient Lending, honesty and transparency are non-negotiable. I love hopping on the phone to walk through these trends with you, explaining the subtle details so you can make informed decisions. Whether it's your first home or you're expanding your portfolio, we're here to help you create a legacy through smart real estate financing.

Curious how this affects your specific market in CO, TX, or FL? Drop a comment below, DM me on X at @mike_lending, or give us a call. And if you're into deeper dives on building wealth in real estate, check out my podcast, Mosaic: The Stories of Real Estate. The intro episode is here on Spotify.

Let's build something lasting—together.

Mike Nelson, CEO - Efficient Lending, Inc