Why Home Values Might Surprise You During a Recession

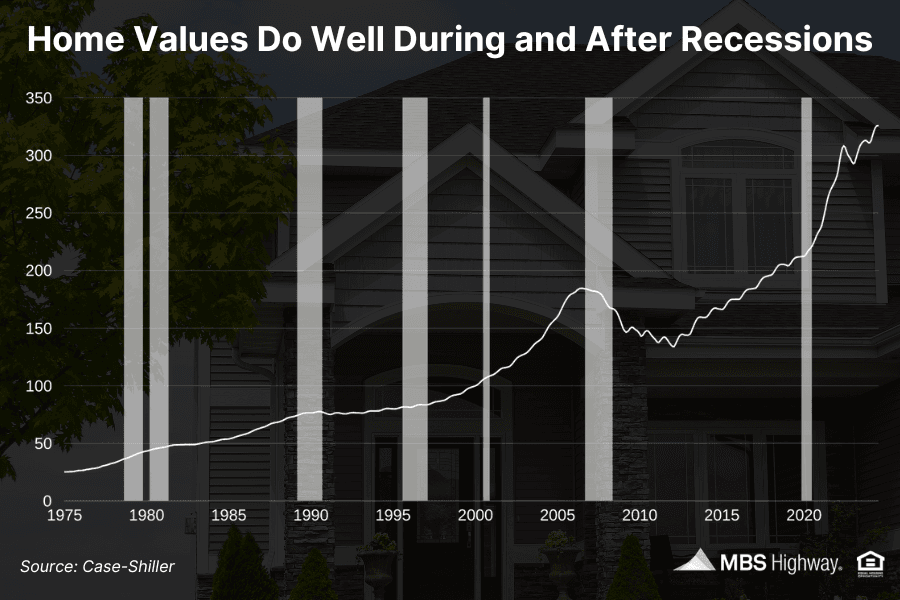

With whispers of an impending recession, many homeowners and prospective buyers are bracing for a potential hit to home values. It’s a natural concern—economic downturns often bring visions of plummeting markets and financial uncertainty. But what if the data tells a different story? Contrary to popular belief, a fascinating graph from MBS Highway reveals that home values have historically performed remarkably well through the vast majority of recessions. Let’s dive into why this counterintuitive trend holds true and what it means for today’s housing market.

The Recession-Home Value Myth

When we think of recessions, we often picture widespread economic turmoil: job losses, stock market dips, and declining asset values. It’s easy to assume that real estate, one of the largest investments for most households, would take a significant hit. After all, if people are tightening their belts, wouldn’t fewer buyers mean lower home prices?

Not necessarily. The data paints a surprising picture. According to the graph shared by MBS Highway, home values have not only remained stable but often appreciated during most recessionary periods. This challenges the conventional wisdom and prompts a closer look at the factors driving this resilience.

Why Do Home Values Hold Up?

Several key dynamics help explain why home values tend to weather recessions better than expected:

What the Data Shows

The MBS Highway graph highlights several recessionary periods over recent decades, overlaying them with home price trends. In most cases, home values either continued to rise or experienced only modest declines before quickly recovering. For example:

Since the Great Recession, home prices have shown even greater resilience, supported by tighter lending standards, low inventory, and strong demand. Even during the brief but sharp economic contraction of 2020 caused by the COVID-19 pandemic, home values surged as buyers sought more space and capitalized on historically low mortgage rates.

What This Means for Today

As fears of a 2025 recession loom, the historical data offers a dose of reassurance for homeowners and investors. While no two recessions are identical, the evidence suggests that home values are more likely to hold steady—or even grow—than to crash. Here’s why this matters:

A Word of Caution

While the data is encouraging, it’s important to acknowledge that past performance isn’t a guaranteed predictor of future results. The Great Recession showed that extraordinary circumstances—like a housing bubble—can lead to significant declines. Additionally, local market conditions vary widely. Areas with strong job markets and limited inventory are likely to fare better than oversupplied or economically struggling regions.

Stay Informed, Stay Ahead

The housing market is complex, but understanding the data can help you make informed decisions. The graph from MBS Highway is a powerful reminder that recessions don’t automatically spell doom for home values. By staying in the know with resources like MBS Highway’s mortgage market news, you can confidently navigate economic shifts.

Whether you’re a homeowner, buyer, or investor, keep an eye on key indicators like inventory levels, interest rates, and local market trends. And don’t let recession fears cloud your judgment—real estate has repeatedly proven that it’s built to withstand the storm.

Michael F Nelson, CEO - Efficient Lending, Inc

720.419.3016 or mike@efficientlending.net or @mike_lending

NMLS: 1876539 NMLS: 1314188

Disclaimer: This blog post is for informational purposes only and should not be considered financial advice. Always consult with a qualified professional before making real estate or investment decisions.