On October 1, 2025, the average 30-year fixed mortgage rate held at 6.37% after weak private payroll data. Bigger shifts may follow when the delayed government jobs report is released.

Published on 10/01/2025

Affordability is finally improving this fall thanks to lower average 30-year fixed mortgage rates, slower home price growth, and rising wages. Learn why now could be the right time to buy.

Published on 09/26/2025

After touching yearly lows early in the week, the average 30-year fixed rose following the Fed’s rate cut—thanks to the dot plot and Powell’s comments. Still, mortgage applications just saw their biggest weekly jump since 2021 as homeowners reacted to earlier rate declines. Here’s what it means for buyers and homeowners.

Published on 09/19/2025

With the Federal Reserve's upcoming meeting on September 17, 2025, the big question on everyone's mind is: Will the Fed cut rates tomorrow? Conventional wisdom—and market expectations—suggests yes, with economists widely anticipating a rate cut of either 25 or 50 basis points. This could be the first cut since December 2024, potentially easing the federal funds rate from its current 4.25%-4.50% range.

Published on 09/16/2025

The average 30-year fixed is holding near the lowest levels since October 2024 after a weak jobs report and cooler inflation. Here’s why—and what to watch at next week’s Fed meeting.

Published on 09/12/2025

Mortgage rates are holding near 10-month lows—but don’t assume they’ll stay there. Learn why rates move, what drives them, and what smart buyers and homeowners should do next.

Published on 09/03/2025

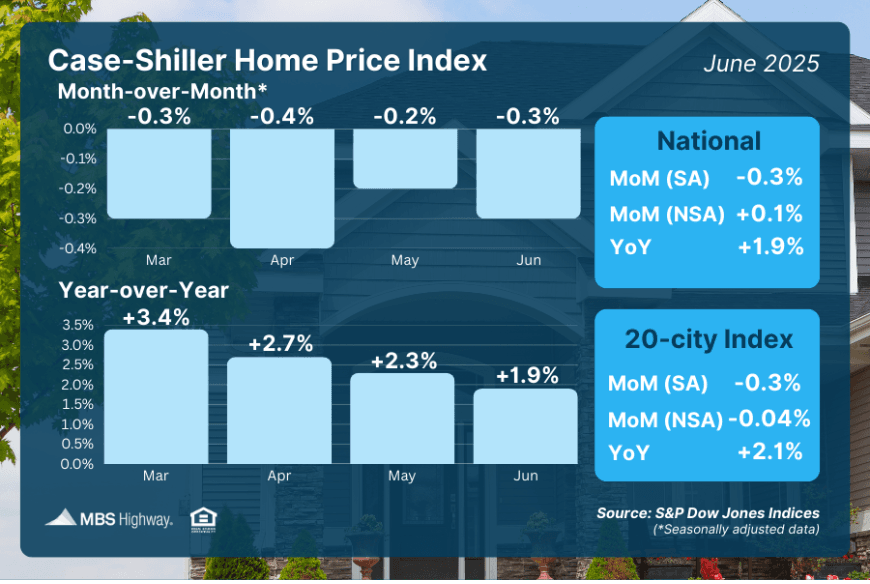

The most recent S&P CoreLogic Case-Shiller Home Price Index, released on August 26, 2025, and covering data through June 2025, offers a clear snapshot of national and regional trends. From May to June, nationwide home values saw a modest 0.1% increase before seasonal adjustment. After adjusting for seasonal trends, prices slipped by 0.3%. Compared to a year ago, home values are up 1.9%, with the 20-City Index mirroring this with a 2.1% annual gain and a -0.3% monthly drop (SA). This data, reflecting a three-month average of April, May, and June closings, highlights a shift toward stabilization (see the attached chart for details).

Published on 09/02/2025

As we wrap up August 2025, the real estate markets in Colorado, Texas, and Florida are firmly tilting toward buyers, with inventory levels continuing their upward climb and providing more options than we've seen in years. This ongoing surge—national inventory up nearly 25% year-over-year in July—means homes are lingering longer, price cuts are commonplace, and negotiation power is shifting. For borrowers eyeing homeownership and agents guiding them through it, this is an opportune moment to act strategically, especially with mortgage rates stabilizing around 6.5%.

Published on 08/27/2025

After Powell's Jackson Hole speech, mortgage rates hit their lowest levels since Oct 2024. But don’t get too comfortable—more movement could be coming after Friday’s inflation data and next week's jobs report.

Published on 08/27/2025